Bank of Ireland cuts all fixed mortgage rates by 0.5pc from today

Cut applies to new and existing customers as competition increases

Bank of Ireland is cutting all its fixed mortgage rates by 0.5pc in a move that will benefit thousands of householders.

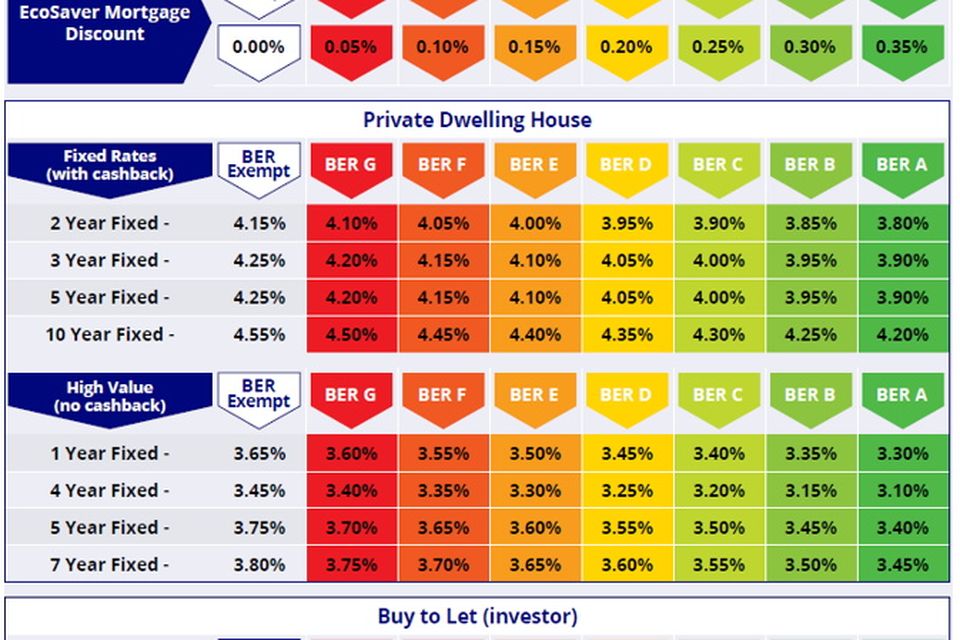

It’s cutting the rate from today for all new and existing customers, and for all homes with a building energy rating (BER) of between A and G.

The move comes amid intensifying competition among lenders as rates fall.

Today’s reduction by Bank of Ireland means that a four-year fixed rate can be obtained for as little as 3.1pc, depending on the property’s BER. That could mean a saving of about €1,000 on a €300,000 mortgage when compared to the previous four-year fixed rates.

The bank is also introducing a new one-year fixed-rate product, with no cashback, with rates starting from 3.3pc for mortgages of €250,000 and over.

The decision by Bank of Ireland to cut its fixed rate comes as the…

We’ve summarized this news for a quick read. If you’re interested, you can read the full article here:

If you find this site helpful, share it with your friends!

If you find this site helpful, share it with your friends!